The potential impact of Hillary Clinton’s email findings on the stock market is a question many investors are asking. Could these revelations cause market fluctuations?

Hillary Clinton’s email controversy has been a significant topic in political circles. Recent findings may bring new insights and raise concerns among investors. The stock market often reacts to political events, and any new development could affect investor sentiment. It is essential to understand the implications of these findings.

Investors need to stay informed and be prepared for potential market changes. This article will explore how these revelations might influence the stock market and what steps investors can take to protect their portfolios. Stay tuned as we dive into the details and potential outcomes.

Impact Of Political Scandals On Markets

Political scandals can create chaos in the stock market. Investors often react quickly to news, affecting stock prices. This blog explores how Hillary Clinton’s email findings might impact the stock market.

Historical Context

Political scandals have long had significant effects on financial markets. For example:

- Watergate Scandal (1970s): The scandal led to a drop in stock prices.

- Lewinsky Scandal (1990s): Market volatility increased during the investigation.

- Russian Interference (2016): Stock markets saw brief dips during key revelations.

These events show how political instability can cause market fluctuations. Investors fear uncertainty. They often sell stocks when a scandal breaks.

Market Sensitivity

Markets are sensitive to political news. This sensitivity can lead to rapid changes in stock prices. Several factors contribute to this:

- Investor Sentiment: News can change how investors feel about the market.

- Media Coverage: Extensive coverage can amplify investor reactions.

- Regulatory Risks: Scandals can lead to new regulations, affecting businesses.

For example, during the 2016 election, news about Hillary Clinton’s emails led to market volatility. Investors reacted to the possibility of her losing the election.

The stock market reacts to both positive and negative news. Good news can boost stock prices. Bad news can lead to a sell-off. This makes it crucial for investors to stay informed.

In summary, political scandals can have a major impact on the stock market. Historical data and market sensitivity show how scandals affect investor behavior. By understanding these factors, investors can make better decisions.

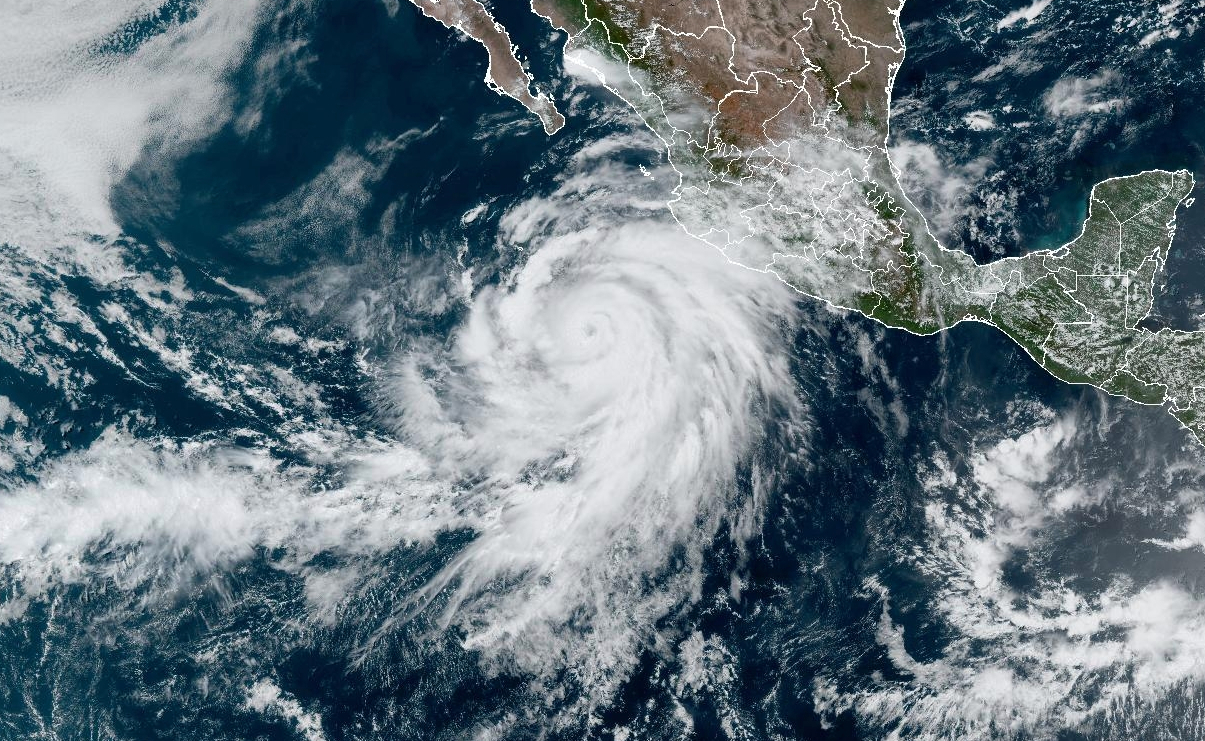

Credit: en.wikipedia.org

Hillary Clinton’s Email Controversy

The Hillary Clinton email controversy was a significant political issue in the United States. It involved the use of a private email server by Hillary Clinton during her tenure as Secretary of State. This raised concerns about national security and transparency.

Background Of The Controversy

During her time as Secretary of State, Clinton used a private email server for official communications. Critics argued this compromised sensitive government information. The server was located at her home in New York. This practice was against State Department rules.

In 2015, it came to light that Clinton had used her private email instead of a government account. The FBI launched an investigation to determine if classified information was mishandled. This raised many questions about compliance with federal laws.

Public And Political Reaction

The public reaction to the email controversy was intense. Many citizens were concerned about the security of classified information. Critics claimed it showed a lack of judgment and transparency.

Politically, the controversy had a significant impact. Opponents used it to question Clinton’s trustworthiness. It was a major talking point during the 2016 presidential election. The controversy also led to increased scrutiny of other candidates’ email practices.

The findings of the email investigation had potential effects on the stock market. Investor confidence can be affected by political instability. Any significant political event can lead to market fluctuations.

In conclusion, the Hillary Clinton email controversy was a major political issue. It raised questions about security, transparency, and trust. Its impact was felt both publicly and politically.

Immediate Market Reactions

The release of Hillary Clinton’s email findings can have an immediate effect on the stock market. Investors closely watch political events, and any significant news can cause instant market reactions. This section will explore how these findings can lead to stock market volatility and influence short-term stock movements.

Stock Market Volatility

Stock market volatility refers to the rapid and unpredictable changes in stock prices. News about Hillary Clinton’s emails can create uncertainty among investors. This uncertainty can lead to increased volatility.

When there is uncertainty, investors might sell their stocks quickly. This can cause prices to drop sharply. On the other hand, some investors might see this as a buying opportunity. They may purchase stocks at lower prices, hoping for future gains.

Volatility can affect different sectors differently. For example, technology stocks might react more strongly to political news than utility stocks. This is because technology companies are often seen as more sensitive to regulatory changes.

Short-term Stock Movements

Short-term stock movements are changes in stock prices over a brief period. The release of the email findings can cause quick movements in the stock market. These movements can be either positive or negative.

Investors may react quickly to the news, buying or selling stocks based on their perceptions. This can lead to rapid price changes. For instance, if the findings are seen as harmful to a political figure, stocks associated with that figure’s policies might drop. Conversely, stocks that benefit from the figure’s potential loss might rise.

Short-term traders often look for these opportunities. They aim to profit from the quick price changes. They might use strategies like buying on dips or selling on peaks to maximize their gains.

Understanding these immediate market reactions can help investors make informed decisions. It is essential to stay updated with political news and be prepared for potential volatility.

Credit: www.nytimes.com

Long-term Market Implications

The long-term market implications of Hillary Clinton’s email findings might be significant. Investors and analysts are watching closely. The potential effects on the stock market could be profound. Understanding these implications helps in making informed investment decisions.

Investor Confidence

Investor confidence plays a critical role in the stock market. If the findings are negative, confidence might drop. This can lead to a sell-off of stocks. Uncertainty can cause panic among investors. Conversely, positive findings can boost confidence. This can result in a rise in stock prices. Investors seek stability and predictability. Any deviation can cause fluctuations in the market.

Market Stability

Market stability is crucial for sustained growth. The email findings could disrupt this stability. Markets dislike uncertainty. Volatility can increase as a result. Stability ensures steady growth and investor trust. Disruptions can lead to unpredictable market movements. Both short-term and long-term effects are possible. The findings might shape market behavior for years to come.

Sector-specific Effects

The revelation of Hillary Clinton’s email findings could have varied impacts on different sectors of the stock market. Each industry has unique vulnerabilities and strengths. This means the effects will not be uniform across the board. Let’s delve into how specific sectors might react.

Tech Industry Impact

The tech industry might face significant scrutiny due to its reliance on data security. Investors could become wary of companies with weak cybersecurity. This may lead to a drop in stock prices for such firms. In contrast, companies with robust security measures might see a rise in investor confidence.

- Increased scrutiny on data security.

- Potential drop in stock prices for companies with weak cybersecurity.

- Investor confidence might rise for firms with strong security measures.

Furthermore, the tech industry is closely tied to government contracts. Any negative fallout might influence the awarding of future contracts. This could either be a boon or a bane depending on a company’s current standing.

Financial Sector Response

The financial sector may experience volatility following the email findings. Banks and financial institutions rely heavily on public trust. Any breach in confidentiality or security can lead to a loss of confidence. This could result in a temporary dip in stock prices.

- Volatility due to reliance on public trust.

- Potential temporary dip in stock prices.

- Impact on confidentiality and security perceptions.

Additionally, the financial sector might experience increased regulatory scrutiny. This could lead to higher operational costs. Investors might react negatively to these changes. Yet, companies with strong compliance records might see minimal impact.

Overall, understanding sector-specific effects is crucial for investors. It helps in making informed decisions during uncertain times.

Investor Strategies

Investors are always keen on strategies to navigate market uncertainties. Hillary Clinton’s email findings could impact the stock market. Investors must adopt smart strategies to mitigate risks. Key areas include risk management and diversification.

Risk Management

Risk management is essential for investors. Political events can create market volatility. Investors should assess their risk tolerance. Regularly review and adjust investment portfolios. This helps maintain a balanced approach. Avoid overexposure to any single asset.

Diversification

Diversification spreads investments across various assets. It reduces the impact of a single event. Investors can diversify by sector, geography, and asset type. This strategy helps manage potential losses. It ensures a stable investment portfolio. Consider including stocks, bonds, and real estate.

Expert Opinions

Expert opinions on the potential impact of Hillary’s email findings on the stock market vary widely. Analysts and economists offer diverse perspectives on this topic. Their insights help us understand the potential ramifications. Let’s dive into their views.

Economist Views

Many economists believe political events can affect market stability. Hillary’s email findings might influence investor confidence. This could lead to market fluctuations. Some economists predict short-term volatility. Others foresee minimal long-term impact. They emphasize the importance of market fundamentals. Political events often create temporary market reactions. Economists urge investors to stay focused on economic indicators. These include GDP growth, inflation, and employment rates.

Market Analyst Perspectives

Market analysts offer a different view. They focus on immediate market reactions. Some analysts expect increased market volatility. This could stem from uncertainty around the email findings. Others believe the market has already priced in the news. They argue that investor sentiment plays a key role. Confidence in the political system affects stock prices. Some analysts highlight the importance of sector-specific impacts. Technology and financial sectors might react differently.

Overall, expert opinions provide valuable insights. They help us navigate the potential effects of political events. Understanding these perspectives can aid in making informed investment decisions.

Credit: fortune.com

Future Political Events And Market Impact

The stock market often reacts to political events. Future political events could have a significant impact. Let’s explore upcoming elections and potential regulatory changes.

Upcoming Elections

Upcoming elections can create uncertainty. Investors might react to potential policy changes. This reaction can cause stock prices to fluctuate. Here are a few factors to consider:

- Presidential Elections: A change in leadership can shift market sentiment.

- Congressional Elections: The balance of power in Congress can affect legislation.

- Local Elections: State and local policies can impact specific sectors.

Potential Regulatory Changes

Regulatory changes can have a direct impact on businesses. Investors watch for changes that could affect profitability. Here are some potential areas of impact:

| Regulatory Area | Potential Impact |

|---|---|

| Tax Policies | Changes in tax rates can affect corporate profits. |

| Environmental Regulations | New rules can increase compliance costs for companies. |

| Trade Policies | Tariffs and trade agreements can impact global trade. |

Investors should stay informed about political events. This awareness can help them make better investment decisions.

Frequently Asked Questions

Will Hillary’s Email Findings Impact Stock Prices?

The findings could cause market volatility. Investors may react to potential political instability. The effect will depend on the findings’ severity.

How Do Political Events Affect The Stock Market?

Political events can create uncertainty. This uncertainty may lead to market volatility. Investors often react to potential changes in policies.

Can Email Scandals Influence Investor Confidence?

Yes, scandals can impact investor confidence. Negative news can lead to market sell-offs. Investors often seek stability and predictability.

What Sectors Might Be Affected By Hillary’s Email Findings?

Sectors like finance and technology may be impacted. Political instability can influence regulatory environments. Investors should monitor these sectors closely.

Conclusion

The Hillary email findings might not have a huge impact on the stock market. Investors often focus on broader economic trends. Political events can cause short-term changes, but they rarely shift long-term trends. It’s wise to stay informed and keep a balanced portfolio.

Always consider various factors before making investment decisions. The market is influenced by many things, so stay cautious. Stay updated, stay patient, and invest wisely.

Leave a Reply